The Bruhat Bengaluru Mahanagara Palike (BBMP) has sparked widespread public criticism after issuing 31,000 property tax notices to residents across Bengaluru. Despite mounting backlash from citizens and political groups, the civic body has made it clear that it has no plans to withdraw the notices.

The Bengaluru NavaNirmana Party (BNP) has been vocal in opposing the move, claiming the notices go against Supreme Court rulings and the Real Estate (Regulation and Development) Act, 2016 (RERA). The controversy has raised concerns over transparency, legality, and the impact on ordinary property owners.

What is BBMP Property Tax ?

According to Munish Moudgil, BBMP’s Special Commissioner, the notices were issued after comparing the property area mentioned in the sale deed with the area for which tax has been paid. The civic body claims this process revealed discrepancies that led to tax evasion demands.

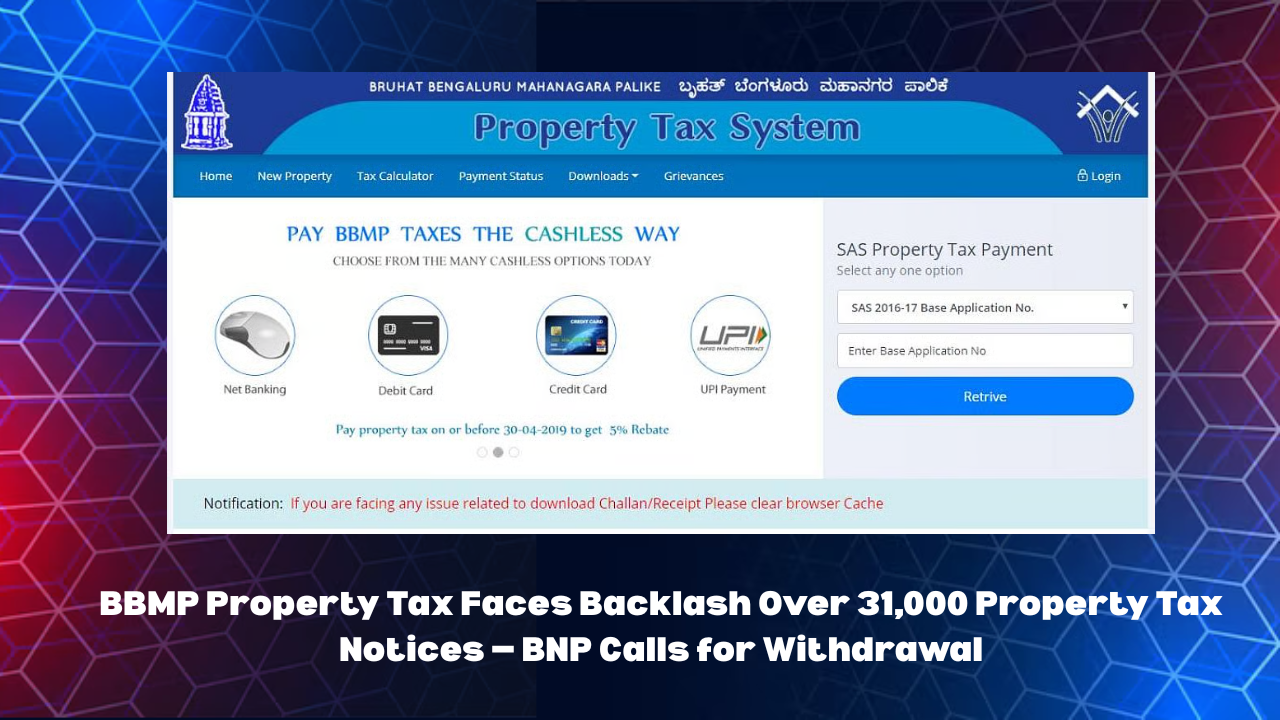

Moudgil also stated that each notice includes a detailed calculation showing how the tax amount was determined. He added that this is the first time BBMP has introduced an online system allowing property owners to file objections or appeals without visiting physical offices.

Previously, such notices were issued by field staff with no digital option for residents to contest the claims.

BBMP Property Tax :But Is the System Working?

BBMP insists that property owners can use its E-Nyaya web portal to raise objections or appeal against the tax demands. However, many residents report that the portal is unresponsive or malfunctioning.

BNP leader Venkatachalam Subramaniam from Varthur alleged that Assistant Revenue Officers (AROs) are refusing to accept responses submitted by hand. This has further frustrated residents, who say they are left without a reliable channel to contest the notices.

BNP’s Stand: Notices Are Unjust and Illegal

The Bengaluru NavaNirmana Party argues that these property tax notices are legally flawed.

BNP founder Srikanth Narasimhan points out that in many apartment complexes, parking areas are included in the common areas of the property. These areas are already part of the super built-up area, which is taxed in full. According to Narasimhan, owners have the right to use these spaces but do not own them individually, meaning they should not be taxed separately again.

BNP claims this move by BBMP places an unwarranted financial burden on citizens, causes stress, and creates confusion about the property tax calculation process.

Legal Concerns: Supreme Court and RERA Provisions

BNP has stressed that the notices are in violation of Supreme Court judgments and RERA guidelines. Under RERA, common areas in apartment projects — including parking spaces, corridors, and gardens — are jointly owned by all residents. These areas cannot be taxed as though they are individual units owned separately.

Legal experts warn that if BBMP continues with these notices, it may face a wave of legal challenges from residents and housing societies.

BBMP Property Tax Impact on Bengaluru Residents

The sudden demand for additional property tax has caught many citizens off guard. Residents say that they have already paid full property taxes based on the super built-up area mentioned in their sale deeds.

For some, the amounts mentioned in the notices run into tens of thousands of rupees, creating unexpected financial stress. Apartment owners are particularly concerned, as they fear BBMP might target more properties in the future if these notices are not withdrawn.

Housing associations and resident welfare groups are now discussing collective legal action to challenge the BBMP’s decision.

BBMP’s Transparency Push — A Step Forward or Backward?

BBMP maintains that its online objection system is a citizen-friendly reform aimed at improving transparency in property tax collection.

In theory, this digital approach could streamline tax disputes, reduce in-person visits, and allow faster resolutions. However, in practice, the non-functioning portal and unresponsive local offices are making the process more difficult for residents.

The clash between BBMP’s technological claims and ground reality has only deepened mistrust between citizens and the civic body.

Key Issues Raised in the BBMP Property Tax Notice Row

- Double Taxation Concerns – Residents argue they are being taxed twice for the same property area, especially for parking spaces already included in the super built-up area.

- Legal Violations – BNP claims the notices defy Supreme Court judgments and RERA provisions regarding common property areas.

- Technical Glitches – The E-Nyaya portal, meant for objections, is reportedly not functioning properly, leaving residents without a reliable appeal process.

- Lack of Communication – Citizens say they were not given prior notice or clear explanation before being sent the demands.

- Financial Burden – Unexpected tax bills have caused stress and confusion among property owners.

What Citizens Can Do if They Receive a BBMP Property Tax Notice

If you have received one of these notices, here are the steps you can take:

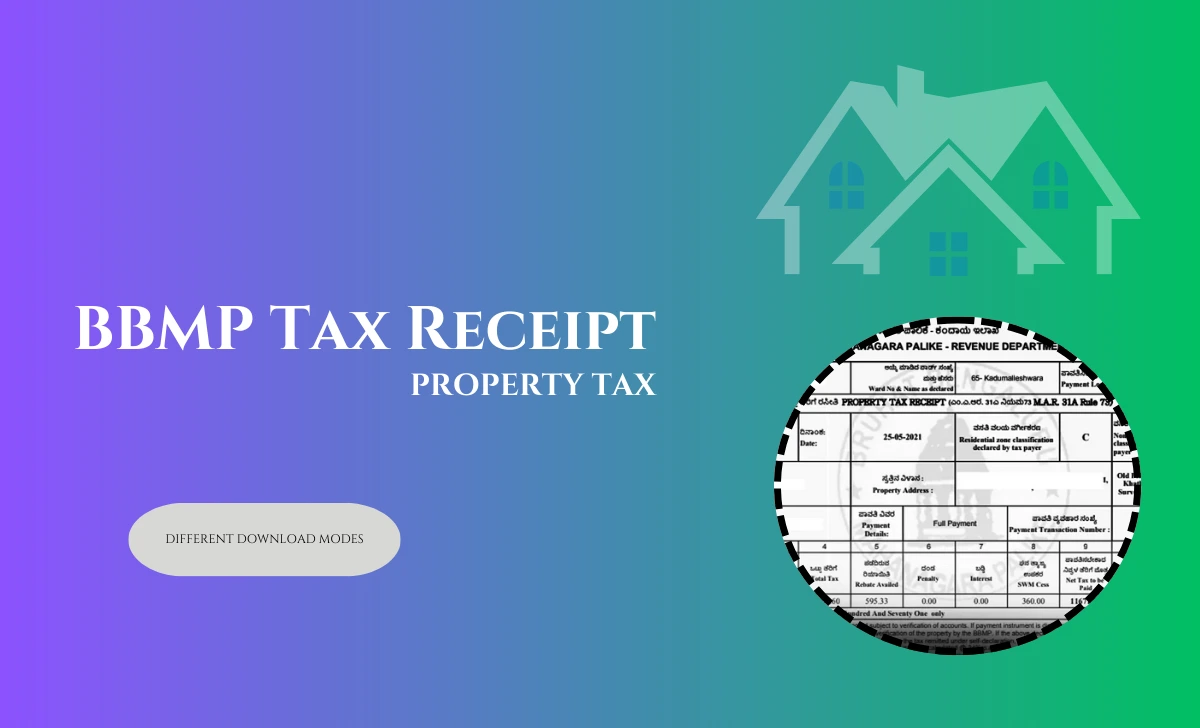

- Check the details carefully – Compare the property size in the notice with your sale deed and past tax receipts.

- File an objection online – Try using the BBMP’s E-Nyaya portal to submit your response.

- Document your case – Keep records of all sale deeds, tax payment proofs, and correspondence with BBMP officials.

- Engage with your housing society – Collective representation may have more impact than individual complaints.

- Seek legal advice – If the amount is significant or the case is complex, consult a lawyer familiar with RERA and property tax laws.

Future Implications

If BBMP continues enforcing these property tax demands, it could set a precedent for similar actions in other Indian cities. However, if BNP and citizens succeed in challenging the notices, it may push civic bodies to rethink their property tax assessment methods.

Given the current tensions, experts believe BBMP might have to improve its digital objection platform and provide clearer guidelines to avoid further backlash.

BBMP Property Tax Conclusion

The BBMP property tax notice controversy has become a major flashpoint between Bengaluru residents and the city’s civic administration. While BBMP defends its move as a necessary and transparent tax enforcement step, the BNP and affected citizens view it as unfair, legally questionable, and financially burdensome.

With legal challenges looming and citizen protests growing louder, the coming weeks will determine whether BBMP stands firm or is forced to revisit its approach. For now, Bengaluru’s property owners are left navigating a confusing and stressful tax battle that shows no signs of ending soon.

FAQS

- Why has BBMP issued 31,000 property tax notices?

BBMP claims the notices were sent after finding mismatches between the property area in sale deeds and the area for which tax has been paid. - What is BNP’s objection to these notices?

BNP says the notices violate Supreme Court rulings and RERA provisions, and amount to double taxation on common areas like parking. - How can citizens contest a BBMP property tax notice?

Residents can file objections or appeals through BBMP’s E-Nyaya portal, though many report technical issues. - Are parking spaces taxable under RERA?

Under RERA, parking in common areas is jointly owned and already included in the super built-up area for tax purposes, so it shouldn’t be taxed separately. - What problems have citizens faced while responding to the notices?

Many say the online portal isn’t working and local BBMP offices are refusing to accept objections by hand.

Read this to earn money online